vermont income tax rate 2020

Vermont based on relative income and earningsVermont state income taxes. This calculator estimates the average tax rate is the state income tax liability divided by the total gross income.

Per Capita Sales In Border Counties In Sales Tax Free New Hampshire Have Tripled Since The Late 1950s While Per Capita Sales In Big Sale Clothing Store Design

The taxable wage figures are taken.

. Pay Estimated Income Tax by Voucher. For those subject to the middle rate schedule the top rate has dropped from 60 to 59 percent. VT Taxable Income is 82000 Form IN-111 Line 7.

This means that these brackets applied to all income earned in 2019 and the tax return that uses these tax rates was due in April 2020. Tax Year 2020 Personal Income Tax - VT Rate Schedules. Tue 01282020 - 1127am --.

Vermonts tax system consists of a state personal income tax estate tax state sales tax local property tax local sales taxes and a number of additional excise taxes on. Vermont Tax Brackets for Tax Year 2020. Some calculators may use.

There are -774 days left until Tax Day on April 16th 2020. 2020 Vermont Tax Rate Schedules Example. Pay Estimated Income Tax Online.

W-4VT Employees Withholding Allowance Certificate. These income tax brackets and rates apply to Vermont taxable income earned January 1 2020. Vermont state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with VT tax rates of 335 66.

Your free and reliable 2020 Vermont payroll and historical tax resource. Vermont Business Magazine The 2020 tax season officially opened on January 27 at both the federal and state levels. Filing Status is Married Filing Jointly.

These income tax brackets and rates apply to Vermont taxable income earned January 1 2020 through December 31 2020. Vermont Income Tax Calculator 2021. How to Calculate 2020 Vermont State Income Tax by Using State Income Tax Table.

The Vermont Single filing status tax brackets are shown in the table below. Find your pretax deductions including 401K flexible account. The tax rates are broken down into groups called tax brackets.

New Yorks income tax rates range from 4 to 882. This is the date. On an annual basis the department and IRS conduct a cross match to ensure that employers are paying both taxes.

IN-111 Vermont Income Tax Return. IN-111 Vermont Income Tax Return. The rate notice provides you with your new unemployment tax rate.

Vermont School District Codes. The top tax rate is one of the highest in the country though only individual taxpayers whose taxable income exceeds. LC-142 2020 Instructions 2020 File your Landlord Certificate Form LC-142 online using myVTax or review the online filing instructions.

Tax Tables 2020 2020 Vermont Tax Tables. W-4VT Employees Withholding Allowance Certificate. Base Tax is of 3220.

Your free and reliable 2020 Vermont payroll and historical tax resource. It is sent out annually in June and the rate is effective from July 1st until June 30th. Vermonts income tax brackets were last changed two.

5 Massachusetts single-rate individual income tax dropped from 505 to 50. Income tax brackets are required state taxes in. Vermonts income tax brackets were last changed two years prior to 2020 for tax year 2018 and the tax rates were previously changed in 2017Vermonts tax brackets are indexed for inflation.

Pay Estimated Income Tax by Voucher. 2020 VT Tax Tables. As you can see your Vermont income is taxed at different rates within the given tax brackets.

PA-1 Special Power of Attorney. 2020 Vermont Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. Provided the state does not have any outstanding Title XII loans payment of.

Compare your take home after tax and estimate. PA-1 Special Power of Attorney. Vermont Income Tax Rate 2020 - 2021.

Vermont new heavy and civil engineering. The IRS will start accepting eFiled tax returns in January 2020 - you can start your online tax return today for free with TurboTax. Any income over 204000 and 248350 for.

Find your income exemptions.

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax States Small Towns Usa

Vermont Income Tax Calculator Smartasset

What To Expect If You Go To The Pub This Weekend Coffee Bar Restaurant Cozy Bar

The Carlson Law Firm Carlsonlawfirm Twitter Monsanto Law Firm Influential People

When And Where To File Your Tax Return In 2018 Tax Return Tax Paying Taxes

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Vermont Income Tax Brackets 2020

State Corporate Income Tax Rates And Brackets Tax Foundation

Maine S Tax Burden Is One Of The Highest New Study Says Mainebiz Biz

Vermont Income Tax Calculator Smartasset

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

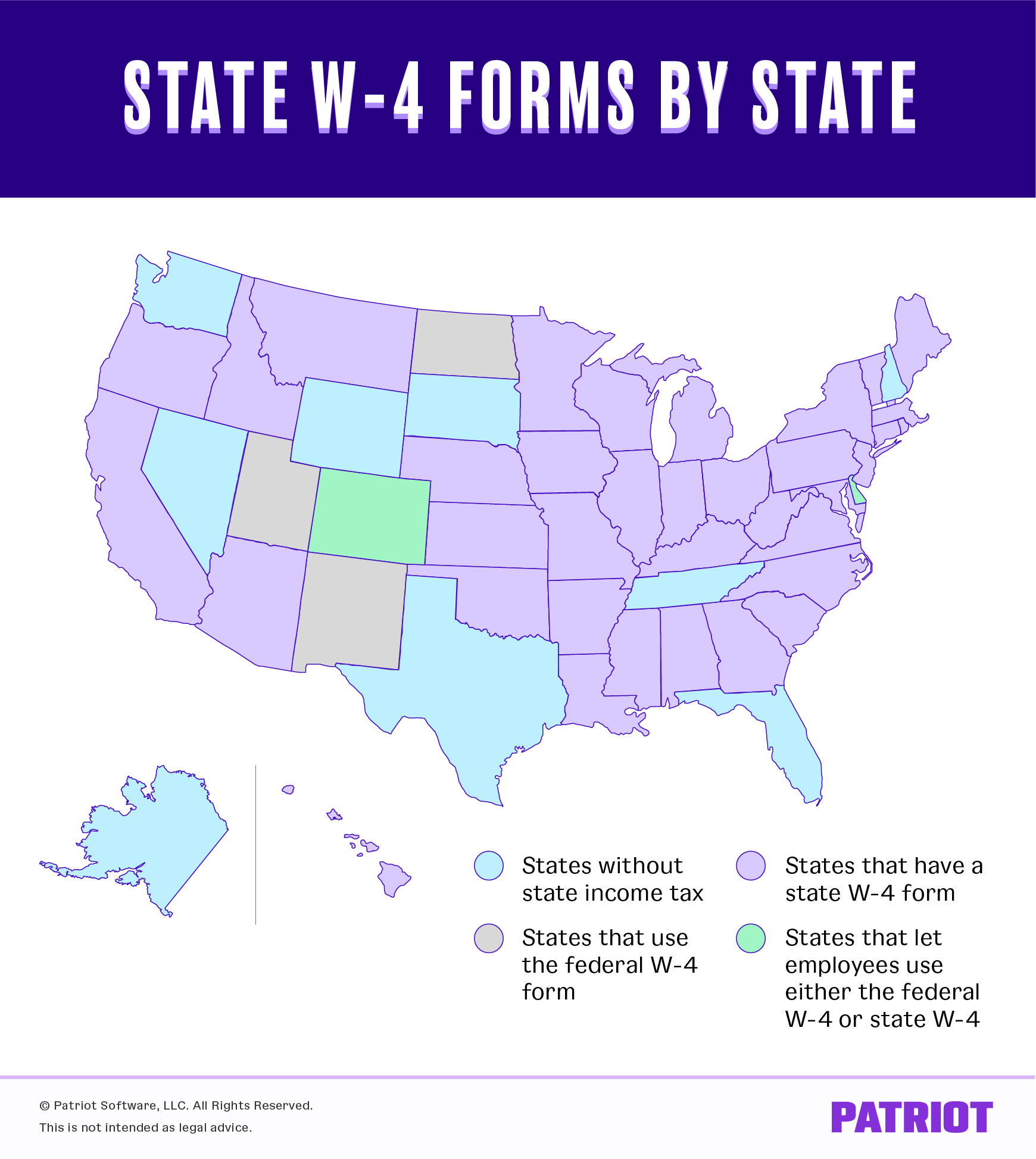

State W 4 Form Detailed Withholding Forms By State Chart

Vermont Income Tax Calculator Smartasset

How Bad Are The State Controlled Metropolitan Transportation Authority S Finances Last Week Metropolitan Transportation Authority Borrow Money The Borrowers

936 Brandon Mountain Rd Rochester Vt 05767 5 Beds 4 Baths Fenced In Yard Picturesque Farm

Tax Burden By State 2022 State And Local Taxes Tax Foundation