florida estate tax apportionment statute

See Part IV for a discussion of. Trust Bank of America Private Wealth Management.

How Can You Reduce Your State Tax Apportionment

Estates of Decedents who died on or after January 1 2005.

. The Florida apportionment statute has finally received a welcomed facelift. QTIP bears the additional estate taxes arising due to its inclusion in Ws federal gross estate by reason of. The value of an interest shall not be reduced by reason of the charge against it of any part of the tax.

Floridas current apportionment statute originated in 196321 and was amended in 196522 The 1965 amendments included foreign estate and in- heritance taxes in the apportionment. NEW FLORIDA APPORTIONMENT OF ESTATE TAXES Florida Laws 1949 c. 3 See Braun Akins Price Improvements Made to Floridas Estate Tax Apportionment Statute Action Line Summer 2015 p.

4 Laws 2015 c. Bank of America NA. The 2022 Florida Statutes.

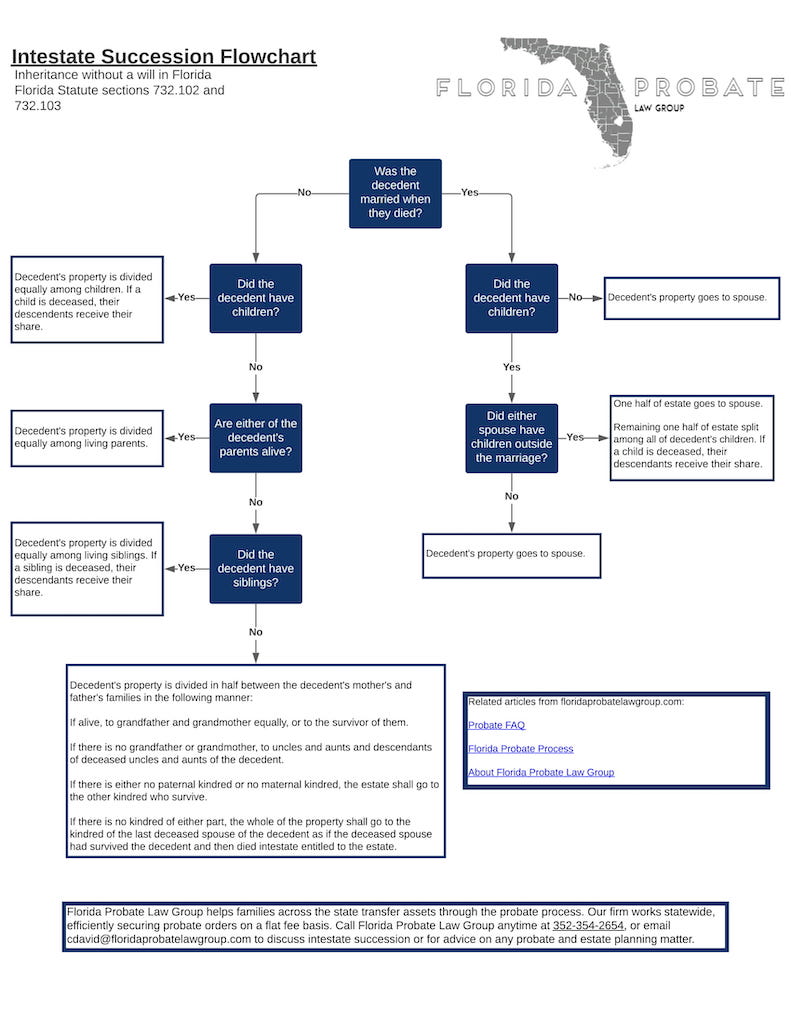

ADMINISTRATION OF ESTATES PART VIII SPECIAL PROVISIONS FOR DISTRIBUTION. 2021 Florida Statutes 733817 Apportionment of estate taxes. Florida Statutes 733817 Apportionment of estate taxes.

Floridas Estate Tax Laws--Apportionment Versus a Change Against Published by UF Law Scholarship Repository 1959. The revised apportionment statute became effective October 1 1992. Until its recent revision the statute remained basically unaltered since 1963.

25435 Chapter 25435 enacted by the Florida Legislature in 1949 provides that unless the decedent has. 2 An interest in protected homestead shall be exempt from the apportionment of taxes. 2012 Florida Statutes TITLE XLII ESTATES AND TRUSTS Chapter 733 PROBATE CODE.

Traditionally the common law pre-sumed that estate taxes were. Of the Florida Statutes the Apportionment Statute which is the section of the Florida Probate Code that governs the apportionment of estate taxes2 The impetus for the Amendment was a. A Remainderman means the holder of the remainder interests after the expiration of a tenants.

An analysis of the history of estate tax apportionment reveals the clear effect of Floridas apportionment statute. A Fiduciary means a person other than the personal representative in possession of property included in the measure of the tax. Ws will does not contain a tax apportionment clause.

Improvements Made to Floridas Estate Tax. 738801 Apportionment of expenses. 733817 Apportionment of estate taxes.

Improvements Made to Floridas Estate Tax Apportionment Statute Action Line Summer. As determined by the Internal Revenue Code with respect to the federal estate tax and the Florida estate tax and as that concept is. Chapter 198 Florida Statutes.

No Florida estate tax is due for decedents who died on or after January. The Estate Tax Law of Florida imposes a GST tax based on the amount allowed as a credit for state legacy taxes under IRC 2604. FLORIDAS TAX APPORTIONMENT STATUTE By.

As determined by the Internal Revenue Code with respect to the federal estate tax and the Florida. FLORIDAS TAX APPORTIONMENT STATUTE By. FLORIDAS ESTATE TAX LAWS tax is a charge against the.

The Complete Guide To Florida Probate 2022 Florida Probate Blog January 2 2022

Uc Davis Summer Tax Institute Advanced Income Tax Track Ppt Download

Debunking Last Will And Testament Myths Haimo Law

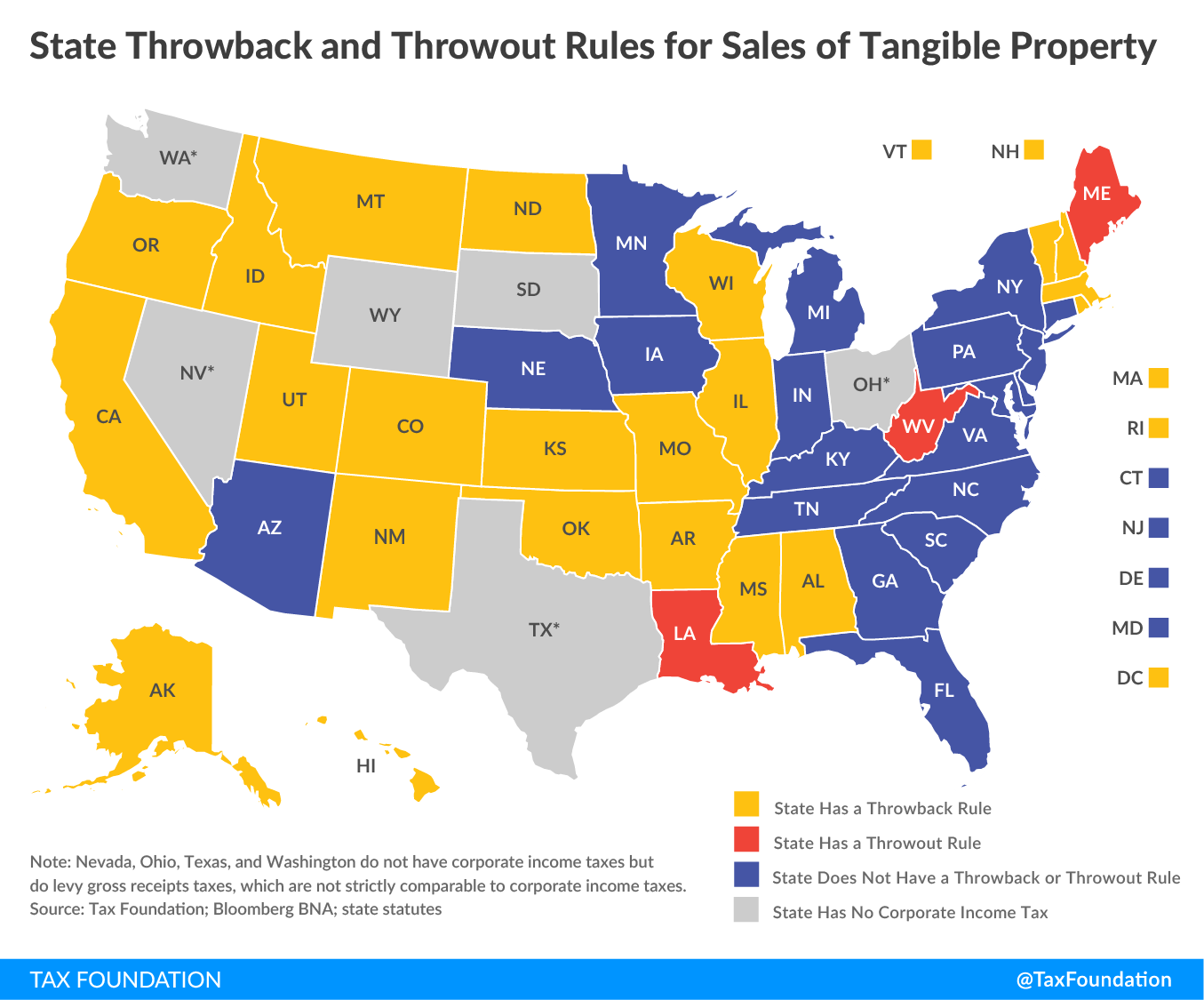

State Throwback Rules And Throwout Rules A Primer Tax Foundation

The Complete Guide To Florida Probate 2022 Florida Probate Blog January 2 2022

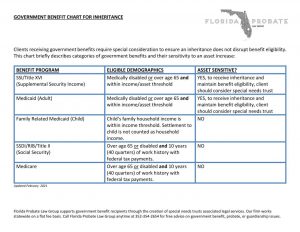

When Are Beneficiaries In Florida Liable For Inheritance Tax Deloach Hofstra Cavonis P A

History Tax Section Of The Florida Bar

The Complete Guide To Florida Probate 2022 Florida Probate Blog January 2 2022

Beneficiary Rights Estate Planning Probate Attorney

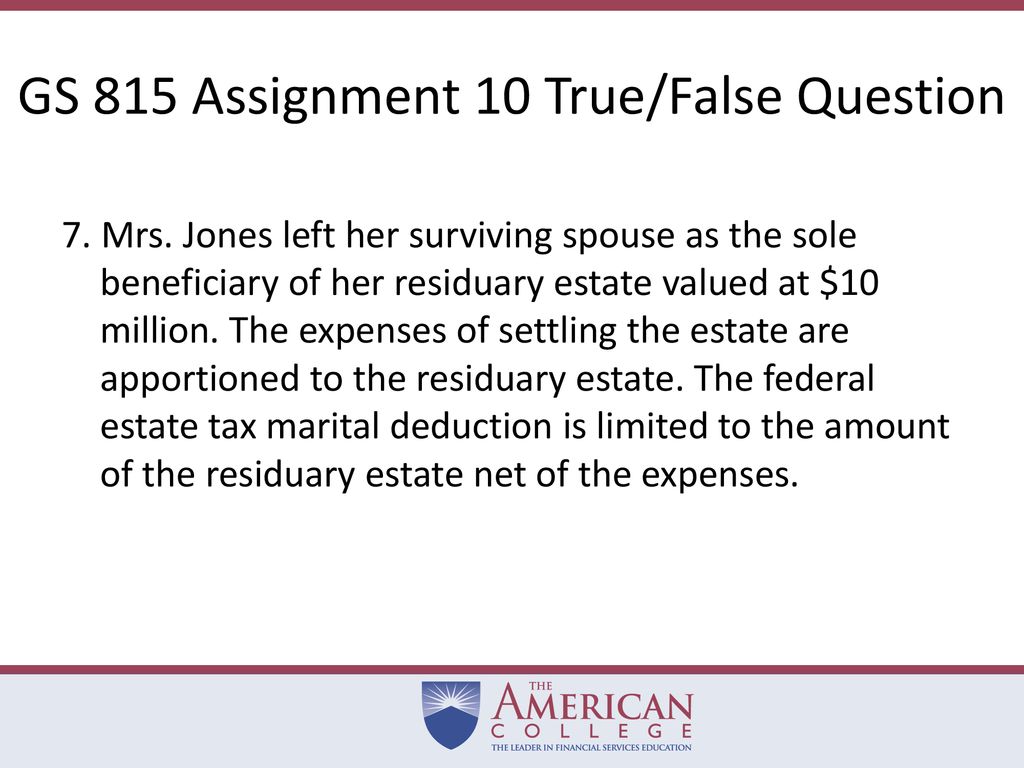

Gs 815 Advanced Estate Planning Ppt Download

Special Provisions For Distribution Under Florida S Probate Statute Haimo Law

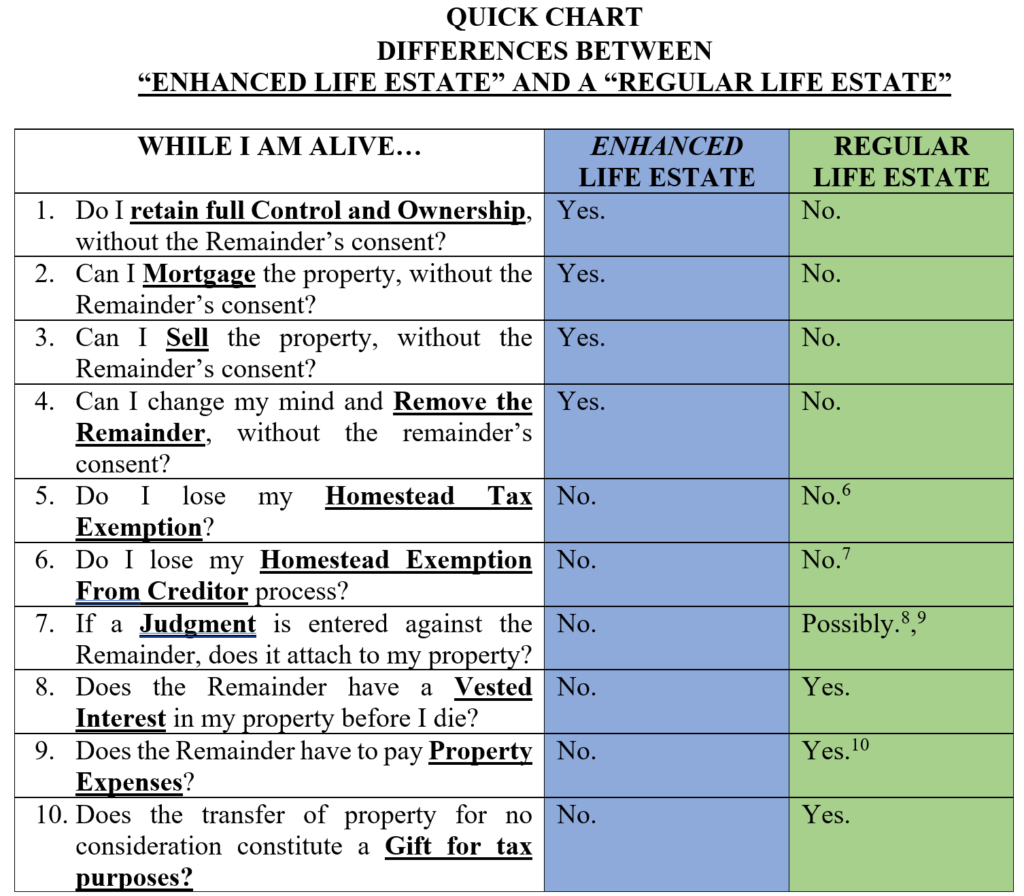

Giving The Bird Lady Bird Deeds Florida S Title Insurance Company

News Events Blogs Page 76 Of 149 Dean Mead

Giving The Bird Lady Bird Deeds Florida S Title Insurance Company

State Tax Update The Shift From Cost Of Performance To Market Based Sourcing Marcum Llp Accountants And Advisors

Planning For Limited Life Expectancies Scroggin Burns Llc

Does Your State Have A Throwback Or Throwout Rule

Csc Florida Laws Governing Business Entities Annotated Lexisnexis Store

Csc Florida Laws Governing Business Entities Annotated Florida Bar